EFA in the News

EFA Partners Article in Film Journal: M&A Activity in Film Exhibition

November 8, 2018

The Global Economy and the Changing Landscape of the Film Exhibition Industry

The past several years have shown unprecedented changes in the business world, with much of that spawned from technological advances and the growing dynamics of social media. Each country’s economic outlook is becoming more and more intertwined with the rest of the world. This has resulted in companies seeking an increased global reach.

This outlook has transformed many industries, including film exhibition. The industry that was once dominated by the Hollywood studios and the North American box office has now entered a new era. International box office is growing at a record pace with 2017 at $29 billion, up from $24 billion five years earlier in 2012. This is over 2 ½ times North American box office of $11 billion, only modestly up from $10.8 billion in 2012. The number of international screens has also grown, primarily fueled by China which increased its screens in the past ten years from about 5,000 to almost 49,000. This surpassed the total of the North American market which has about 43,000.

The film exhibition industry has found it necessary to transform itself with the digital age. Almost all screens in North America and worldwide are now digital. The advent of digital projection has reduced the costs associated with movie delivery, while also providing for benefits such as 3D movies, increased alternative content, more dynamic sound, motion seating, laser projection, and more efficient auditorium usage. However, the digital age has also provided increased theatre competition from movie streaming services such as Netflix, Amazon, Hulu, and others. This has forced film exhibitors to be innovative with enhanced services and amenities such as luxury recliner seating, enhanced food options, beer, wine and cocktails, in-theatre dining, and even adding attractions such as bowling and laser tag.

All of the above has culminated in much consolidation within the film exhibition sector in the past few years, resulting in an increase in theatre values. Certain companies worldwide are seeking to expand their business platforms, while others are electing to sell rather than invest in theatre upgrades.

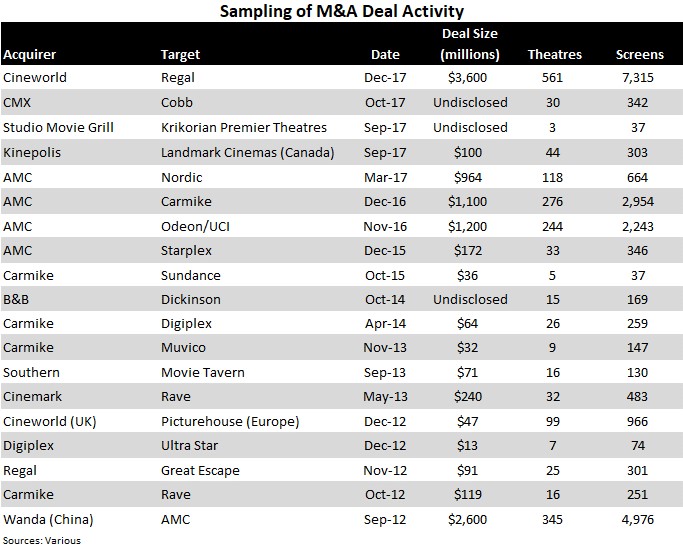

M&A Activity

The film exhibition sector has recently seen major consolidation globally. Up until recently, most consolidation had been regional, such as various acquisitions in the U.S. or companies such as Odeon and Vue acquiring companies throughout Europe.

This changed dramatically with Dalian Wanda entering the market. In less than three years, it acquired AMC in the U.S., Hoyts in Australia, and, subsequently, AMC acquired Carmike, Odeon/UCI and Nordic. Following a similar path to growth, U.K. operator Cineworld acquired Regal Entertainment, making it one of the industry’s largest companies.

Wanda and Cineworld are not alone in the pursuit of establishing an international platform. Others have expanded into North America such as European exhibitor Kinepolis acquiring Landmark Cinemas in Canada, Mexico’s CMX acquiring Cobb Theatres in the U.S., and Mexico’s Cinepolis acquiring certain U.S. theatres from Bow Tie Cinemas and from Krikorian Premier Theatres.

In the U.S., various exhibitors have grabbed market share by acquiring theatre circuits that are complementary to their existing theatre portfolio.

Motivation of Acquirers

Larger exhibitors are continuously seeking ways to increase shareholder value via growth, whether from building new theatres, upgrading existing theatres, acquisitions, or some combination thereof.

While organic growth or upgrades can result in a significant returns on capital over the long term, acquisitions can result in near term increases in revenue and profitability. Wanda has demonstrated this with its various acquisitions as it quickly gained marketshare in countries where it previously had little or no presence. More recently, Wanda has curtailed its growth due to the cash constraints associated with growing so quickly.

Larger exhibitors with an established corporate infrastructure have an advantage as they can acquire theatres based upon a multiple of theatre level cash flow without absorbing duplicative corporate overhead.

Acquisitions can also take place when exhibitors wants to venture into new theatre platforms. This was demonstrated when Southern Theatres acquired Movie Tavern to delve into the increasing popularity of in-theatre dining.

Motivation of Sellers

The motivation of sellers varies greatly depending on the outlook of ownership. Smaller exhibitors may not have easy access to the capital necessary to upgrade and stay competitive in their markets.

Also, owners of theatres that are operated by older generations may not have the inclination to go through an extensive upgrade project as the pay-back can be long for investments in luxury seating and other amenities.

Another primary factor is the current market. Traditionally, film exhibition companies have sold in the range of 6 times the net theatre level cash flow. The multiple varies depending upon the size of the theatre portfolio, capital expenditures needs, and the economic outlook for the theatres’ markets.

While these factors all still play an important role in acquisition pricing, cash flow multiples for larger circuits are now as high as 8 times, and potentially higher for exhibitors with diversified revenue sources such as in-theatre dining. These increases are primarily due to new entrants in the industry paying a premium to gain marketshare.

On the other hand, many exhibitors are currently focused on deploying capital for their theatre upgrades so are reluctant to sell until they see the benefits of the upgrades that will in turn increase their overall circuit value.

Real Estate

As exhibitors explore strategic options, those that own their theatres’ real estate have an alternative to selling the business by instead only selling the real estate. This can be accomplished via a sale/leaseback transaction which can provide owners with significant funds but also allows them to continue operating their theatres.

Exhibitors of all sizes have completed sale/leasebacks including large exhibitors such as AMC and Regal, and mid-sized exhibitors such as Georgia Theatre Company, Krikorian Premier Theatres, Muller Family Theatres, and many others.

As compared to a mortgage in which banks typically lend 60-70% of property value and the funds must be used for the business, a typical sale/leaseback provider will buy the property at full value and the proceeds can be used for ownership dividends, capital expenditures, or other needs. Typical lease terms are 15-20 years with several extension options. In most cases, the providers of this type of financial instrument require the rent to be about 1/2 of the cash flow generated by the theatre to provide a cushion in the event of a downturn in profitability.

There are certain financial companies that have a focus on theatre sale/leasebacks, and more have recently entered the market. All understand the increasing value of theatre properties in good markets.

Conclusion

The global economy and the digital age have brought significant change to many industries, including film exhibition. While the industry has grown, as demonstrated by the increased number of theatres and rising box office, theatre owners have needed to be innovative to compete against streaming services. This has resulted in opportunities for both buyers and sellers in the sector. Many companies feel that acquisitions are the quickest route to gain market share, while others want to sell to take advantage of increasing business values rather than investing capital for upgrades. While this trend may slow down, M&A activity could remain very prevalent during the next several years as both potential buyers and sellers explore an ever changing business environment.

About EFA Partners

EFA Partners is a boutique financial advisory firm that provides investment banking services focused on M&A and arranging capital for entertainment, media and technology companies. Its industry expertise and relationships has allowed it to successfully close well over $1 billion of transactions for companies involved in the film industry ranging from production to distribution to exhibition. EFA has arranged several M&A transactions in the film industry. In addition, it has also arranged numerous financings for industry film clients via its wealth of relationships from which to source capital include local and regional banks, national and international banks, specialty finance groups, equipment financiers, providers of mezzanine debt and private equity groups.